Many member states of the eurozone are confronted to the puzzle of sustainable public finances, caused among other factors by a pressure on public spending related to an ageing population. In this context a first step would be a thorough review of demographic projections. This blog aims to have a look at where we stand and shed some light on potential challenges that may arise from demographic trends in the Grand-Duchy, especially pensions, healthcare and long-term care.

The Luxembourg economy has some unique features. Key-characteristics related to our analysis are the high degree of economic openness (the ratio of exports to GDP is the highest among the country-members of eurozone), the high percentage of cross-border workers (43.8% of total employment, the highest among all member states in eurozone) and the high ratio of immigrants to total population (44.4% in 2013, highest among all member states in the eurozone).

Demographic assumptions: which scenario?

IDEA has developed a demographic model for Luxembourg. This model adopts assumptions which are very close to the ones put forward in EUROPOP2013[1] by Eurostat and have been used by the Ageing Working Group[2] (AWG) in its recent projections dedicated to the future cost of ageing. In particular, we have assumed a constant birth rate and a decreasing death rate separately estimated by age and by sex. The latter assumption makes our model more realistic and is in congruence with the observed increase in longevity.

We can make “sensitivity projections” under many different scenarios with respect to birth and death rates, net migration and integrated different dimensions, especially cross-border workers. However, here we present just two scenarios: the “Strong migration” (as per EUROPOP2013) and the “Zero migration”. The objective of this blog is not to “endorse” any of these two “extreme” scenarios, but rather to initiate a debate about the demographic evolution in Luxembourg and the related challenges and questions.

In the “Strong migration” scenario we have adopted the net migration flows that have been considered by the AWG in the long term (i.e. till 2060) – the resulting scenario is therefore nearly identical to the AWG baseline demographic scenario. Under this perspective, net migration flows will increase until 2022, when they will reach almost 2% of the total population of Luxembourg. This rate will by assumption gradually decline until it reaches 0.4% in 2060. Taking into consideration that in the “Strong migration” scenario our assumptions (birth and death rates, migration flows) are very close to these of the AWG it is not a surprise that our projections for population developments are also very close to these of the AWG.

At the antipode, we present the theoretical case of “Zero migration”. This is an extreme case in which net migration would be zero all over the projection horizon. Although it is a theoretical case, we consider it in order to show clearly the sensitivity of Luxembourg demographics (and consequently public finances) to this immigration variable – this economic interpretation of immigration is often overlooked in the public debate.

More generally, it must be highlighted that projections, especially over long horizons and with volatile variables (typically the case of the Luxembourg economy), are very sensitive not only to exogenous factors and shocks (energy or financial crises, technological progress) but also to the assumptions (lower net migration, higher net migration, etc)[3].

What do numbers tell about the current and future situation in Luxembourg?

The starting simulation presented in table 1 is only a kind of “control experiment”. As it is indicated by the demographic projections, the population of the Grand-Duchy of Luxembourg is estimated to increase by 113% until 2060 – which is very close to the reference projection of the AWG (110.5%). This is by far the highest increase among the countries of EU28, leaving behind Belgium, with an increase of 37.7% according to the AWG and Sweden with an increase of 36.3%. Total population in Luxembourg would reach 1 million inhabitants from 2046 onwards, namely double the current population. This would have consequences on basically all aspects of the socio-economic development of Luxembourg: public finances, the labour market, spatial planning, the education system, energy, environment, etc.

Several of these impacts would be favourable, as illustrated by a counterfactual “experiment” with no immigration. In 2013, the number of net immigrants to the total population was along with Italy equal to 1.9 %, which is by far the highest among EU28. It is estimated that in 2060, accumulated net migration as a percentage of total population (that is the cumulated sum of all migration flows during the years divided by the total population in 2060) is going to be the highest among EU28 with 37.5%, followed by Italy with 23.4%. Finally and very importantly for our pension system, the dependency ratio (that is to say the ratio of the resident population above 65 years to the population aged between 15-64) will be 0.38 in 2060, namely the second lowest in the EU behind Ireland with 0.36. Another old-age dependency ratio, calculated in the same way but with the pivotal age of 60 instead of 65, would go from 0.27 in 2013 to 0.49 in 2060. This latter definition of the old-age ratio is particularly relevant in Luxembourg, where the effective retirement age is close to 60 (instead of 65 namely the official legal retirement age).

Table 1: Projections of Total Population, Net migration and Total dependency ratio, “Strong migration” scenario

Source: Eurostat, Calculations IDEA

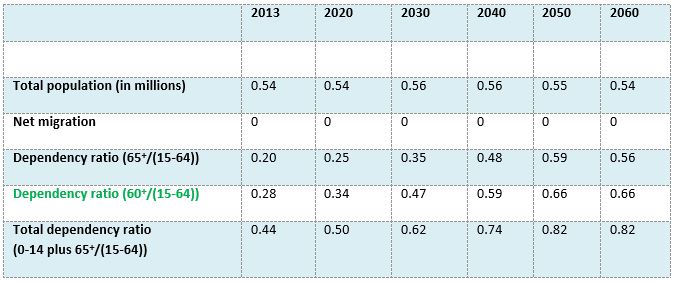

Table 2 presents total population, net migration and the dependency ratios in the extreme case of “Zero migration”. In this scenario, the total population would remain relatively constant until 2060, but the old age dependency ratio centred on 60 years would increase in a dramatic way, as it would go from 0.28 in 2013 to 0.66 in 2060. This dependency ratio would be higher than in the “Strong migration” case by 16 percentage points in 2030 and by 17 percentage points in 2060. This would have tremendous consequences on the financial evolution of social security and particularly on pensions.

Table 2: Projections of Total Population, Net migration and Total dependency ratio, “Zero migration” variant scenario

Source: Eurostat, Calculations IDEA

Source: Eurostat, Calculations IDEA

Impact of demographics on public finances

According to the baseline (“Strong migration”) simulation made by the AWG, ageing would imply an increase in the public expenditure ratio equal to about 6% of GDP, of which 4% for pensions. This is the most unfavourable projection result in the EU, in spite of the fact that it rests on the very dynamic demographic scenario outlined above – the most prominent feature of this scenario being the “Luxembourg with 1 million inhabitants”.

Should the alternative “Zero migration” scenario prevail, the evolution would be even less favourable according to preliminary calculations made by IDEA:

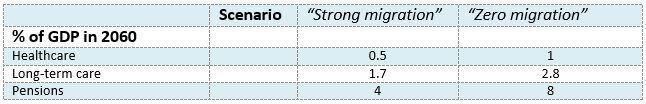

The healthcare expenditure ratio would increase by about 0.5% of GDP from 2013 to 2060 according to the 2015 AWG report (baseline projection). Projections made by IDEA are in close agreement with this result. However, the very same IDEA projection tool indicates that the health expenditure ratio would increase by 1% of GDP from now to 2060, instead of 0.5% under the alternative, “Zero migration” scenario – assuming like the AWG that only half of the impact of ageing would be felt on healthcare expenditure[1]. Long-term care: this is a relatively recent (introduced in 1998) and a fast growing segment. For Luxembourg and based on its dynamic baseline demographic scenario, the AWG assesses the increase in the expenditure ratio at 1.7% of GDP in 2060 compared to 2013. Based on the respective proportions of persons aged 60 or more (accordingly a simplification) and assuming like the AWG that only half of ageing translates into additional expenditure – due to presumably improving dependency rates as time passes by – IDEA estimations show an increase in the ratio from 2013 to 2060 at 2.8% of GDP instead of 1.7%.

Pensions: the related trends are more difficult to estimate, but should pension expenditure as a percentage of GDP be proportional to the (60 year) old-age demographic dependency ratio (or rather to the changes in the dependency ratio compared to the baseline), then the pension bill (pension expenditure ratio) would increase by about 8% of GDP until 2060, compared to 4% of GDP assumed in the AWG baseline. This 8% increase would be (quite logically) close to the one assumed in the 2012 AWG report, characterised by a much more subdued demographic scenario than the 2015 AWG report.

Table 3: IDEA estimations of public expenditure as percentage of GDP for the two scenarios.

Source: Eurostat, Calculations IDEA.

Source: Eurostat, Calculations IDEA.

All in all and even with quite conservative assumptions, the total expenditure ratio related to healthcare, long-term care and pensions would increase by about 12% of GDP rather than the 6% assumed by the AWG – namely about the double, due to the “Zero migration effect”. This could be partly offset by the lower number of younger people (family allowances, education), but this impact should not be exaggerated. These two expenditure items jointly represented 8% of GDP in Luxembourg (2013 data, Statec and IGSS). Should we adjust them for the proportion of persons aged 0 to 18 (a “rule of thumb”) and disregarding all other drivers, the related expenditure ratio would decrease by 1.3% of GDP from now to 2060 under the “Zero migration” scenario. This is only a small fraction of the aforementioned increase by 12% of GDP. In addition, we made a rough estimate, as expenditure per pupil could increase more than implicitly assumed – due to institutional rigidities, the action of vested interest or the necessity to upgrade our education and training system in the “knowledge society”.

…and quite a few other aspects

Demographic developments would have strong impacts on many other aspects of public finances and the economy at large.

For instance, demographic evolutions in Luxembourg interact closely with the evolution of cross-border workers: they are two sides of the same coin. Under the AWG “Strong migration” scenario, the “1 million Luxembourg” would need 280.000 cross-border workers in 2060, assuming in line with the AWG hypothesis that real GDP growth would gradually decline, from 3% to about 1.5%, over the projection horizon (slightly higher employment participation rates are also assumed). The number of cross-border workers would under the same assumptions be equal to 220.000 in 2030 (compared to some 160.000 today).

In the case of a continuous high growth scenario with yearly growth rates of GDP 3% and 4% up until 2060 (as opposed to a gradual decline to 1.5%) the number of cross-border workers would reach 490.000 and 930.000 respectively (with an increase in productivity equal to 1.2% a year). In order to reach the 4% growth benchmark, Luxembourg would therefore need six times more cross-border than now entailing tremendous consequences on the need for new infrastructures (roads, rail connection to neighbouring countries, etc.).

A growing resident population is a way to alleviate these problems (in addition residents consume in Luxembourg a larger proportion of their income than cross-border workers). But a growing resident population generates problems of its own, in particular the additional needs associated to a growing resident population: impact on spatial planning and real estate prices, public transports, sports and culture, schools and nursery facilities etc. Without commensurably high public investments and more flexible building procedures, these numerous aspects could easily turn into bottlenecks. The housing market in particular is of paramount importance: current house prices are already high in Luxembourg. The “1 million nation” would of course increase the pressure on demand and therefore housing prices, unless a “quantum leap” takes place on the supply side.

Conclusions

Demographic projections for Luxembourg are an intricate and very complex issue. The analysis presented here shows that under certain assumptions and all other things remaining equal, a “Strong migration” scenario is much more favourable for social security than the alternative and extreme “Zero migration” scenario. It is however straightforward, though we have not covered it in an explicit way, that the “Strong migration” scenario will give rise to challenges concerning infrastructures, energy and environment, education and social cohesion. Therefore, there is a need for full-blown and truly global cost-benefit analyses, which would include in a comprehensive way all aspects and impacts (economic, social, environmental) of alternative demographic scenarios. Such an analytic move is useful in most countries and indispensable in Luxembourg.

[1] This does not mean that the absolute level of healthcare expenditure would be higher: it would actually decline, due to the much smaller GDP (and in spite of the higher ratio to GDP). But healthcare revenue would decline even more in absolute value (as healthcare revenue would remain stable as a percentage of GDP).

[1] EUROPOP2013 (European Population Projections, base year 2013) contains statistical information on population projections, further information can be found at:

http://ec.europa.eu/eurostat/web/population-demography-migration-projections/population-projections-data

[2] The 2015 Ageing Report, Underlying Assumptions and Projection Methodologies, European Economy 8|2014, http://ec.europa.eu/economy_finance/publications/european_economy/2014/pdf/ee8_en.pdf

[3] Further information and analysis on this subject is provided by the ex post comparative ananalysis of Statec

http://www.statistiques.public.lu/catalogue-publications/economie-statistiques/2015/82-2015.pdf

One thought on “The one million Luxembourg: a global analysis is needed”